Green bonds, also known as climate bonds, are earmarked for climate or environmental projects. They have been labeled as “green” by the issuer according to certain criteria and 95 percent of the proceeds must finance green or environmental projects.

Wealthier cities can issue their own bonds for capital expenses. However, developing country cities often lack the creditworthiness to issue bonds; less than 20 percent of these cities have access to local capital markets through issuing bonds, and only 4 percent are deemed creditworthy enough to access international capital markets (CPI 2016).

Green bonds are usually issued by international development agencies or private entities and are backed by the issuer’s balance sheet and assets.

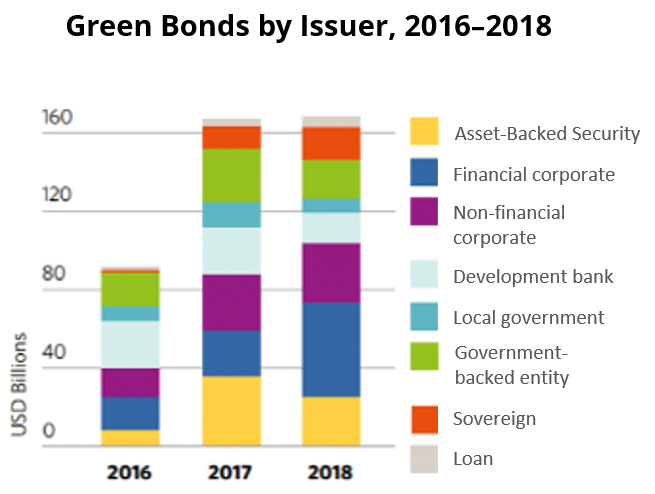

- Historically, development finance institutions like the World Bank or the Asian Development Bank issued green bonds, but now an array of commercial banks and corporations (like energy utilities) are flooding into the green bond market.

- Green bonds grew from US$2 billion in 2012 to US$162.1 billion in 2017 and reached US$167.6 billion in 2018 (CBI 2019). An estimated 60 percent of green bond issuance in 2018 was dedicated to urban infrastructure.

- Green bonds represent roughly 25 percent of sustainable investments. They are the most easily tracked private source of financing because of their disclosure requirements.

The CPI report, Green Bonds for Cities: A Strategic Guide for City-level Policymakers in Developing Countries, explores long- and short-term strategies for cities in developing countries to unleash the full potential of finance from green bonds.